Kauri Crypto Card - a card with transparent fees

| Year | RIS | Commission | Cost | Social networks |

|---|---|---|---|---|

|

Рік

2024

|

RIS

80%

|

Commission

1%

|

Cost

0 EUR / 20 EUR

|

Kauri Finance is a European fintech company headquartered in Estonia that combines traditional banking services with Web3 technologies. Since 2018, the company has been providing solutions for cryptocurrency management, IBAN account issuance and Mastercard cards with instant crypto-to-euro conversion. The founder is believed to be Ukrainian entrepreneur Oleksii Pavlov, and the company holds a license to operate in the EU.

One of the company’s key products is Kauri Crypto Card, which allows users to make payments and withdraw cash using their crypto assets.

Features and benefits of Kauri Crypto Card

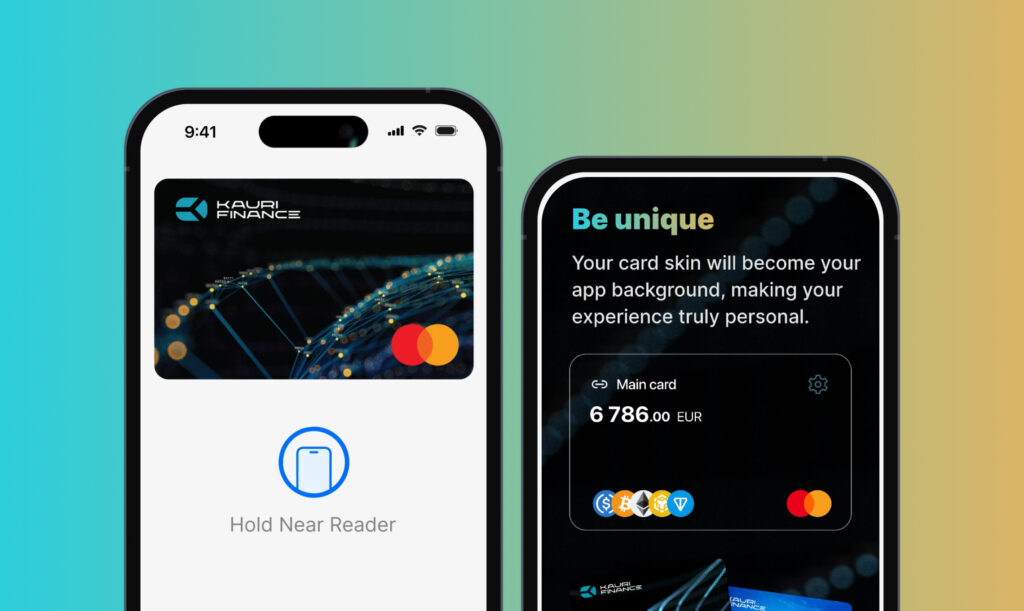

Kauri Card is a debit crypto card that enables real-world crypto payments in everyday life through Apple Pay, Google Pay or a physical Mastercard.

- Crypto payments: The card allows users to pay for goods and services with cryptocurrency, just like a regular bank card.

- Cash withdrawals: Users can withdraw euros from any ATM after topping up the card with cryptocurrency.

- Virtual and physical cards: Users can order a virtual card for online purchases or a physical personalized card for offline payments.

- Free transfers between users: The platform allows free crypto transfers between Kauri users.

- Security and licensing: Kauri Finance has been licensed in the EU since 2018 and employs advanced security measures to protect users’ funds.

The new crypto card integration makes everyday transactions even easier! Kauri Finance crypto cards are fully compatible with Apple Pay and Google Pay. From grocery shopping to your morning coffee, you can now make daily purchases quickly and securely using your crypto, — Kauri Finance on the X network.

How to get a Kauri Crypto Card

Ordering a card is simple and takes minimal time — after verification, the currency card becomes available for issuance.

- Register on the platform: Visit the official Kauri Finance website or download the mobile app and create an account by providing the required personal details.

- Choose your account type: Select “Personal.”

- Identity verification: Complete the KYC (Know Your Customer) process by uploading identity documents and taking a selfie.

- Set up a Web3 wallet: After verification, create a Web3 wallet that will be used to manage your crypto assets.

- Order the card: Log in to your account, go to the “Cards” section, and choose the type of card (virtual or physical).

- Pay the issuance fee: Pay a one-time fee of €20 for a physical card.

- Add the card to Apple Pay or Google Pay via the app.

- Top up your balance: Add funds to your wallet using supported cryptocurrencies such as BTC, ETH, USDT, etc. Funds are converted automatically and the card is ready to use.

Once registration and KYC are complete, you will receive a virtual card for instant payments. The physical card is available for EU residents or anyone who prefers a plastic card — it integrates easily with popular payment tools.

Fees and limits

All Kauri Card fees are officially stated, including issuance costs, transaction fees and set limits.

Fees:

- Issuance of primary virtual card: €0

- Monthly maintenance for primary virtual card: €0

- Additional virtual cards: €1

- Monthly maintenance for additional virtual cards: €1

- Physical card: €20

- Monthly maintenance for physical card: €1

- Top-ups (including P2P): 1%

- Automatic conversion (deposit, exchange, payment): 1%

- Transfers between Kauri cards: Free

- ATM withdrawals: 1.5% + €1.5

- PIN change or balance inquiry at ATM: €0.5

- Chargeback: €30

- IBAN: Issuance €10, maintenance €10/month

Limits:

- Monthly transaction volume: 3 BTC

- Daily top-up or transfer limit: €10,000

- Annual top-up or transfer limit: €100,000

- IBAN transaction limit: up to €1,000,000

The fees are transparent, but it’s important to consider the regular maintenance cost and charges for specific operations.

Drawbacks

Despite its advantages, there are a few limitations worth considering:

- Monthly maintenance fee: €1 is charged for the physical card.

- Physical card issuance fee: €20 one-time cost.

- ATM withdrawal fees: Relatively high at 1.5% + €1.5 per transaction.

- No cashback program: Transactions do not provide rewards.

- IBAN costs: Opening and maintaining IBAN accounts is relatively expensive.

Kauri Card is a modern card with competitive terms, but it might be less appealing for users who frequently withdraw cash or expect cashback rewards.

Kauri Crypto Card is an affordable, fast solution for those planning to actively spend crypto in everyday life. It combines the convenience of instant transactions, Apple Pay/Google Pay support, transparent fees and high limits. However, users should keep in mind the monthly physical card fee, top-up and withdrawal costs and the lack of cashback.

Video reviews of Kauri Crypto Card

Was this article interesting?

Frequently asked questions

This section contains answers to the most common questions about the Kauri Crypto Card. Learn how the card works, what you need to get one and how to use it conveniently every day.