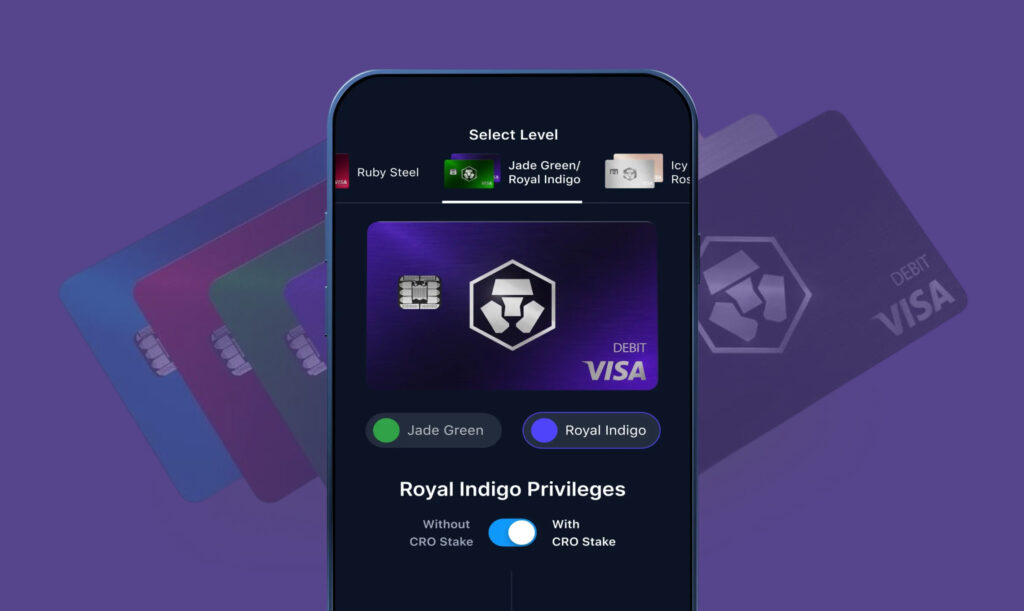

Crypto.com Visa Card - a universal crypto card with privileges for active users

| Year | RIS | Commission | Cost | Social networks |

|---|---|---|---|---|

|

Рік

2020

|

RIS

87%

|

Commission

1-2.99%

|

Cost

from 4.99$

|

Crypto.com Visa Card is a universal tool for integrating cryptocurrency into everyday finances. Founded in 2016, Crypto.com platform now serves millions of users worldwide, offering convenient access to over 250 digital assets, staking and interest-earning opportunities, as well as tools for interacting with DeFi protocols.

Special attention is paid to security: assets are stored in cold wallets, multisignature protection is applied and international certification standards are implemented. This ensures a high level of trust among users who choose the platform for long-term storage and management of their investments.

The main advantage of Crypto.com Visa Card is the ability to spend cryptocurrency at any merchant worldwide that accepts Visa. Cardholders receive cashback in CRO tokens, access to airport VIP lounges and additional perks such as free subscriptions to popular streaming services — all depending on the card tier.

Thanks to the combination of a multifunctional app, strong security measures and a wide range of benefits, Crypto.com Visa Card is considered one of the most popular tools for those integrating cryptocurrencies into their financial routine.

Features

Crypto.com Visa Card is a debit card that allows users to spend their cryptocurrencies anywhere Visa cards are accepted. The card is available in several tiers, each offering different benefits based on the amount of CRO tokens (the platform’s native cryptocurrency) staked:

- Midnight Blue: Debit card (€4.99 issuance fee) with no CRO staking requirement. 0% cashback on daily spending.

- Ruby Steel: Requires staking $500 worth of CRO. 2% cashback on daily spending and 6 months of free Spotify subscription.

- Royal Indigo / Jade Green: Requires staking $5,000 worth of CRO. 3,5% cashback on daily spending, 6 months of free Spotify and Netflix, airport lounge access.

- Icy White / Rose Gold: Requires staking $50,000 worth of CRO. 5% cashback on daily spending, permanent free Spotify and Netflix, airport lounge access with a guest, priority support.

- Obsidian: Requires staking $500,000 worth of CRO. 6,5% cashback on daily spending, permanent free Spotify and Netflix, airport lounge access with a guest, priority support, exclusive events.

- Prime: Requires staking $1,000,000 worth of CRO. 8% cashback on daily spending, permanent free Spotify and Netflix, airport lounge access with a guest, dedicated account manager, exclusive events.

The card also offers free ATM withdrawals up to a certain limit, depending on the card tier.

We strive to provide the best experience for our users by combining the benefits of traditional financial products with innovations from the crypto world — said Steven Kalifowitz, Chief Marketing Officer at Crypto.com.

Fees and limits (Europe)

Before ordering a Crypto.com Visa Card, it is important to review its usage terms. While the card makes spending cryptocurrency convenient in daily life, there are certain fees and limitations depending on the selected tier. This section covers potential costs for top-ups, withdrawals or purchases, as well as applicable transaction limits.

Fees

- Physical card issuance: €4.99 (only for Midnight Blue).

- Card reissue:

- Midnight Blue — €45.01

- Other tiers — €50

- Top-up via debit/credit card: 1%

- ATM withdrawals:

- Free within monthly limit (€200 – €1,000 depending on tier)

- 2% fee for exceeding the limit

- Inactivity fee: €5 per month after 12 months without financial activity

- Account closure: €50

Limits

- Maximum card balance: €25,000

- ATM withdrawal limits:

- Daily: €2,000

- Monthly: €10,000

- Annual: €75,000

- Card top-up limits:

- Daily: €25,000

- Monthly: €25,000

- Annual: €250,000

- POS purchase limits:

- Daily: €25,000

- Monthly: €25,000

- Annual: €250,000

How to apply and get a Crypto.com Visa Card

To get a Crypto.com Visa Card, follow these steps:

- Download the Crypto.com app on your smartphone.

- Register and provide the necessary personal details.

- Complete the KYC verification process by submitting identity documents.

- Choose the desired card tier and, if required, stake the corresponding amount of CRO.

- Order the card through the app and wait for delivery.

Drawbacks

Despite its many advantages, Crypto.com Visa Card has some drawbacks:

- High CRO staking requirement: Higher card tiers require significant amounts of CRO to be staked, which can be risky due to cryptocurrency volatility.

- Limits on free ATM withdrawals: Free withdrawals are capped monthly and exceeding these limits incurs fees.

- Geographic restrictions: The card is not available in all countries, limiting its accessibility for some users.

Crypto.com Visa Card remains an attractive product for those seeking to integrate cryptocurrencies into their everyday lives, though potential users should consider the risks and limitations associated with crypto volatility.

Video reviews of Crypto.com Visa Card

Was this article interesting?

Frequently asked questions

Let's break down the Crypto.com Visa Card — simply, clearly and to the point