TOP 20 best crypto cards in 2026

Experts and ordinary users have identified the best cryptocurrency projects for 2026

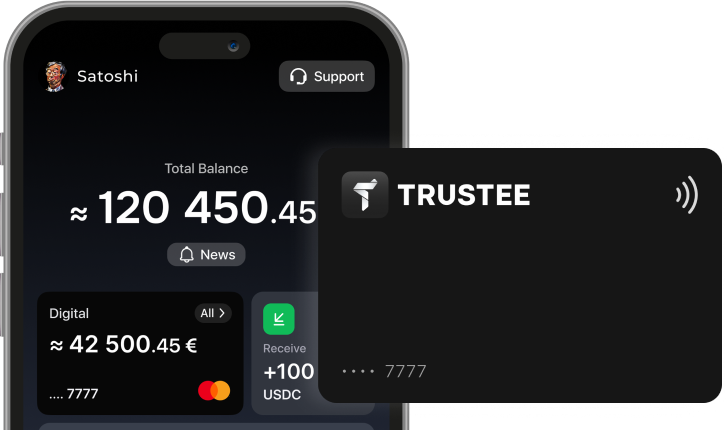

Everyone should have Trustee Plus

Why Are Crypto Cards in High Demand?

Cryptocurrency cards are rapidly gaining popularity in the financial world. They combine the benefits of traditional banking cards with digital assets, making cryptocurrency usage convenient and accessible to a broad audience. Let’s explore the key reasons behind their growing demand.

Ease of Use

Crypto cards allow users to pay for goods and services in regular stores, even if the merchant does not accept cryptocurrency. The card automatically converts crypto into fiat money at the time of payment, making the process as simple as possible for users.

Low Fees and Fast Transactions

Traditional bank transfers often come with high fees and long processing times. Cryptocurrency cards help avoid unnecessary expenses and significantly reduce transaction times.

Global Accessibility

Crypto cards can be used in any country where traditional bank cards are accepted, eliminating the need for currency conversion. This makes them especially beneficial for travelers.

Privacy and Security

Cryptocurrency cards often provide a higher level of privacy compared to traditional financial tools. Thanks to blockchain technology, they are also less susceptible to fraud.

Rewards and Cashback

Many crypto card issuers offer attractive bonus programs, including crypto cashback, discounts, and special promotions.

With these advantages, cryptocurrency cards are becoming an integral part of the modern financial ecosystem, offering flexibility, security, and convenience to their users.

FAQ

In this section, you will find answers to the most frequently asked questions about cryptocurrency cards, including their use, fees, security, and replenishment methods